A dilemma? (photo by Marilyn Swanson) By: Donald L Swanson Bankruptcies with large tort claims are common: some involve a limited number of claimants (e.g., a drunk driver hits a bus or a restaurant serves bad food one evening); and others have large numbers of claimants, some of whom won’t even be known for at least... Continue Reading →

A Rough Day At U.S. Supreme Court, During Oral Arguments, For Debtor’s Counsel (Truck Insurance v. Kaiser Gypsum)

A rough day (photo by Marilyn Swanson) By: Donald L Swanson A mass-tort asbestos case before the U.S. Supreme Court is Truck Insurance Exchange v. Kaiser Gypsum Company, Inc., Case No 22-1079. Here is a link to the transcript of oral arguments in that case, from March 19, 2024. In Truck Insurance, the question is whether... Continue Reading →

Supremes First Side With 144 Claimants Against >82,000 Other Claimants, But Then Vacate: A Good Sign? (Lujan Claimants v. Boy Scouts)

Scouting? (Photo by Marilyn Swanson) By: Donald L Swanson Congress, the federal appellate courts and the U.S. Supreme Court all need to recognize this historical reality: bankruptcy is an efficient and effective tool for resolving mass tort cases, as demonstrated by cases with huge-majority approval votes from tort victims. And all those institutions need to prevent... Continue Reading →

Can Contempt For Violating Discharge Injunctions Be Pursed In A Class Action? (Bruce v. Citigroup)

Showing contempt? (Photo by Marilyn Swanson) By: Donald L Swanson Can the contempt remedy for a creditor’s violations of the discharge injunction in multiple bankruptcy cases throughout the land be imposed in a class action lawsuit? The answer from the First Circuit Court of Appeals is, “No” (see this linked opinion); and On January 8, 2023,... Continue Reading →

Arbitration At U.S. Supreme Court . . . Again, But Not On Bankruptcy—Whew! (Smith V. Spizzirri)

Allowing traffic to pass through (photo by Marilyn Swanson) By: Donald L Swanson Every now and then, the U.S. Supreme Court takes an arbitration case. And it almost always rules in favor of arbitration over litigation. Fortunately, the Supreme Court has, thus far, let arbitration vs. bankruptcy questions pass through without granting certiorari. Presumably, letting them pass... Continue Reading →

Is It OK to Mediate A Mass Tort Bankruptcy Plan Without Including Insurers Who Must Provide Plan Payments? (In re Imerys & Cyprus)

All are included (photo by Marilyn Swanson) By: Donald L Swanson Here’s a due process question that’s percolating before the U.S. Supreme Court and a related mediation issue: The due process question is whether an insurer who must fund a mass tort bankruptcy plan is a “party in interest” that’s entitled to appear and be heard... Continue Reading →

A Scam & Avoidance Claims In Bankruptcy—You Can’t Make This Stuff Up (Mann v. LSQ Funding)

Can’t make this view up! (Photo by Marilyn Swanson) By Donald L. Swanson You can’t make this stuff up. The legal issues are pedestrian. But the facts behind those issues are incredible! Litigation History Here’s the boring stuff first. On January 8, 2024, the U.S. Supreme Court denies certiorari in Mann v. LSQ Funding Group, L.C.... Continue Reading →

Surprise At Oral Arguments In U.S. Trustee v. Hammons: Viability of Prospective-Relief-Only

A retrospective look (photo by Marilyn Swanson) By Donald L. Swanson Oral arguments happened on January 9, 2024, at the U.S. Supreme Court in U.S. Trustee v. Hammons. Here is a link to the transcript of those arguments. The Hammons question is this: what’s the proper remedy for unconstitutionality of lesser fees charged by bankruptcy courts... Continue Reading →

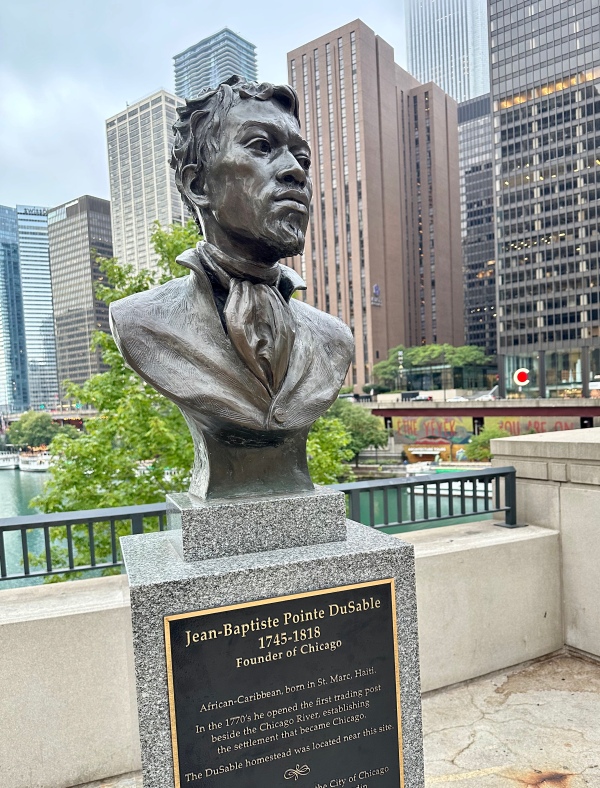

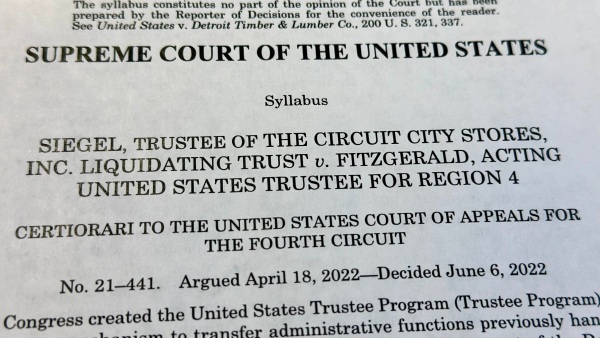

2023 Bankruptcy Boondoggle: Fallout From Footnote 2 in U.S. Supreme Court’s Siegel v. Fitzgerald Opinion

By Donald L. Swanson In 2022, the U.S. Supreme Court issues its unanimous Siegel v. Fitzgerald opinion. The question in that opinion is: whether fee increases for bankruptcy cases, that exempt cases filed in Alabama and North Carolina, are permissible under the U.S. Constitution clause requiring “uniform Laws on the subject of Bankruptcies”; and if not,... Continue Reading →

Narrow and Limited Effect of U.S. Supreme Court’s Stern v. Marshall Opinion (In re Richards)

By Donald L. Swanson I'm reading a U.S. circuit court's recent bankruptcy opinion that cites Stern v. Marshall, 564 U.S. 462 (2011). I'm startled by that and blurt out (to myself), "Who cites Stern anymore?!" and "Is Stern still a thing?!" and "I thought Stern has been narrowed to nearly nothing?!" And then I see... Continue Reading →