Alive and well (Photo by Marilyn Swanson) By: Donald L Swanson You don’t see this very often: a dispute over the confidentiality of mediation communications. But such a dispute recently happened in In re Barretts Minerals, Inc., Case No. 23-90794, Southern Texas Bankruptcy Court. And the result is this: mediation confidentiality remains alive and well. In... Continue Reading →

Is It OK to Mediate A Mass Tort Bankruptcy Plan Without Including Insurers Who Must Provide Plan Payments? (In re Imerys & Cyprus)

All are included (photo by Marilyn Swanson) By: Donald L Swanson Here’s a due process question that’s percolating before the U.S. Supreme Court and a related mediation issue: The due process question is whether an insurer who must fund a mass tort bankruptcy plan is a “party in interest” that’s entitled to appear and be heard... Continue Reading →

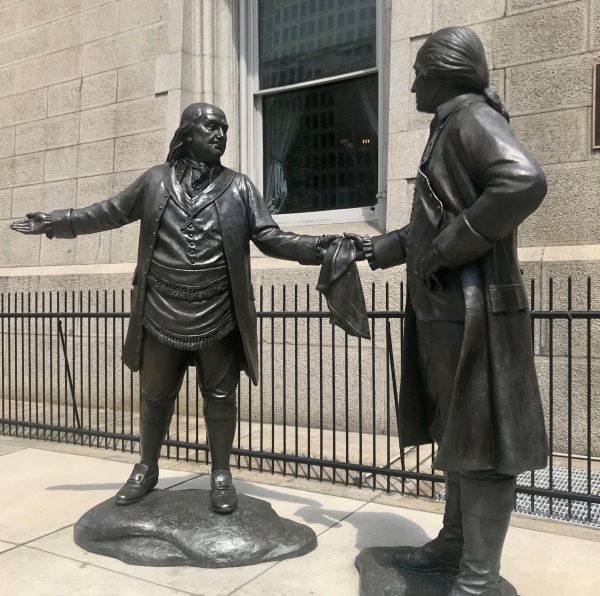

The Handshake: A Negotiating Tool? (A Study)

A handshake? (Photo by Marilyn Swanson) By Donald L. Swanson The handshake, as a social ritual, has been around for a very long time. In days of olde, the handshake probably served a dual role: as a sign of peaceful greeting; and as a way to assure that the other person isn’t holding a dagger or... Continue Reading →

Mandating Mediation–How It’s Done: (i) Local Rule Examples, and (ii) A Separate Order Guideline

A coffee orchard: here's how it's done By: Donald L. Swanson There are many reasons to mandate mediation in certain circumstances. One is to improve the quality of justice. Another is to manage an expanding docket and burgeoning caseload. A third is to create a mediation culture where none currently exists. There are two ways to... Continue Reading →

Refreshing A Concluded Mediation—Because Of Mediator’s Ethics Improprieties In Other Contexts (In re Tehum)

Window refreshed? (Photo by Marilyn Swanson) By: Donald L Swanson Everyone knows by now of a problem in the Southern Texas Bankruptcy Court with a judge who resigned over ethics controversies. That resignation did not solve anything for the cases in which that judge was involved. Instead, the controversies continue to mushroom in a variety of... Continue Reading →

Subchapter V Trustee’s Rights, Powers, Functions & Duties After Removal Of Debtor From Possession

What are the rights, powers, functions and duties here? (Photo by Marilyn Swanson) By: Donald L Swanson This ideal is floating around: upon removal of a Subchapter V debtor from possession, for fraud or other cause, the Subchapter V trustee has no expanded right, power, function or duty beyond operating debtor’s business (the “Ideal”). This Ideal... Continue Reading →

Should Negotiation Offers Be In Round Numbers Or Precise Numbers? (A Study)

Roundness (photo by Marilyn Swanson) By: Donald L Swanson A study on using round-number offers and precise-number offers in negotiations reaches these two conclusions: Round numbers signal completion—and so, negotiators are more likely to accept a round number offer (e.g., $3,000) than a precise number offer (e.g., $3,278.23); and Precise numbers are perceived as factual and... Continue Reading →

How a Judge Makes Mediation Work: Mandatory Mediation

Making it work -- Mandating action (photo by Marilyn Swanson) By Donald L. Swanson Recent expressions of concern about courts mandating mediation reminded me of a mandated mediation process that worked well: the City of Detroit bankruptcy. An illustration of the success of mandated mediation in the Detroit case is this line: The Bankruptcy Judge... Continue Reading →

Enforcing A Mediated Settlement Agreement When Debtor Backs Out (In re Legarde)

Backing away? (Photo by Marilyn Swanson) By: Donald L Swanson The opinion is In re Legarde, Case No. 22-12184, Eastern Pennsylvania Bankruptcy Court (issued September 14, 2023; Doc. 112). Facts Debtor claims Creditor raped her. Then, Debtor posts stuff about Creditor on the internet. So, Creditor sues Debtor for defamation, alleging willful and malicious conduct. Bankruptcy... Continue Reading →

Subchapter V Trustee’s Facilitation Role (Part 3)—A BANKRUPTCY MODEL

Facilitating an adventure (Photo by Marilyn Swanson) By: Donald L Swanson “(b) Duties.—The [Subchapter V] trustee shall— . . . (7)facilitate the development of a consensual plan of reorganization.” From 11 U.S.C § 1183(b)(7)(emphasis added). Facilitation is, by statute, a duty of every Subchapter V trustee—something a Subchapter V trustee must do. But the nature and boundaries... Continue Reading →